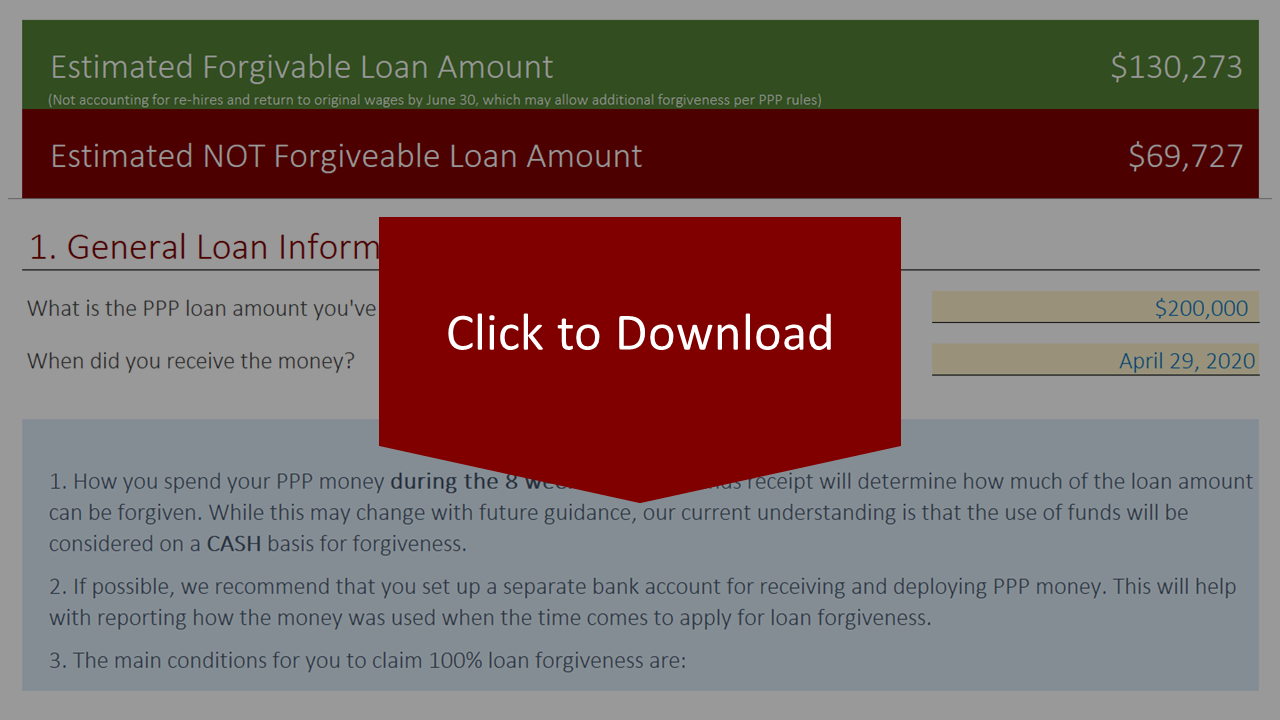

We have created a Loan Forgiveness Calculator to help businesses optimize the use of their PPP loan funds. If you have recently received PPP funds or are expecting to do so shortly, you probably have questions regarding loan forgiveness. The government’s guidance in this regard has been far from clear. So we dug as deep as we could into the program’s rules and consulted with various experts to build this model.

Our calculator may be particularly useful for businesses with hourly or shift staff, as well as for those grappling with questions around production schedules. That being said, note that there may be circumstances specific to your business, which may not be captured by this calculator and might impact the forgivable portion of your loan. For example, your bank may have established some rules of its own on top of the government’s PPP rules. Thus, we advise that you combine the use of this calculator with discussions with your tax advisor and financing partner.

Also bear in mind that even if not wholly forgiven, the PPP offers some pretty unbeatable loan terms including a 6-month payment deferment period, 1% interest, 2 years to payoff, and no prepayment penalties. In this particular case, forgiveness isn’t everything if there are other, holistically better decisions that can be made for your business.

Temporarily Disabled!

Congress is about to vote on a bill that might result in significant changes to the way loan forgiveness is calculated on the PPP. We’re temporarily disabling downloads of our calculator until those changes are enacted and we have an updated version.

Questions? Feel free to reach out and say hello@bernoullifinance.com.